Candidate Experience at North American Banks

In 2019 we struggled to find current research on the candidate experience at North American banks, so we conducted our own!

We wanted to understand exactly what today’s candidates experience at every step of the job search. To uncover meaningful results, we applied to 140 jobs, at 35 different banks. This article provides a deep dive into the recruiting process of key financial institutions in the North American market. To close, this article also summarizes examples of great candidate experiences and areas for improvement.

You might be surprised by what we found.

The State Of High-Volume Hiring at Financial Institutions

As the finance sector continues to be a strong source of economic growth, recruiting for financial institutions faces a new set of challenges. These challenges include competition for hires from tech-based companies like startups as well as the emerging fintech sector.

In addition, diversity and inclusion is a priority across industries. For financial institutions, there’s an especially strong incentive for their workforces to reflect the diversity of their customer base.

“Our research suggests that diversity is moving up the boardroom agenda – nearly three-quarters of the FS industry leaders taking part in PwC’s 18th Annual global CEO survey have a strategy to promote diversity and inclusiveness (59%) or plan to adopt one (14%).” – Diversity and inclusion: Making diversity a reality: PwC

Finally, looking forward, banks are wise to prepare for decreasing headcounts across the board as automation increases. A recent report estimated that, over the next two to three years, machines will be capable of performing approximately 30% of the work currently done at banks (Bank Governance Leadership Network). This means that each hire must be strategic and value-adding.

Pressure From Candidates For On-Demand Hiring & Pay Transparency

Today’s candidates have a consumer mindset: they want fast and easy access to information and they want it on demand. As consumer-focused brands continue to push high-touch, immediate customer service via chatbots, these expectations have shifted into hiring as well and have placed candidate experience as a top recruiting priority.

It is worth noting that alongside candidate experience, compensation is still a key driver for financial service candidates. Offering a competitive salary is increasingly important not only to compete with other financial institutions, but for competing with the startup and fintech sectors as well. One reason is that salary growth is healthy in the banking and financial services sector. Within the same company, raises average 4% while the raise offered to move to another company averages 9%.

In an increasingly tight labour market, employers should look to cater to candidates at scale as well as to provide a higher level of pay transparency earlier in the recruiting cycle.

Ideal’s Candidate Experience Research In The Financial Sector

For the purposes of our study we defined the candidate experience as a candidate’s overall evaluation of the hiring process from sourcing, screening and interviewing. Its evaluation is made up of subjective measures such as the ease of application and the attractiveness of employer brand and objective measures such as time to first contact and time to fill.

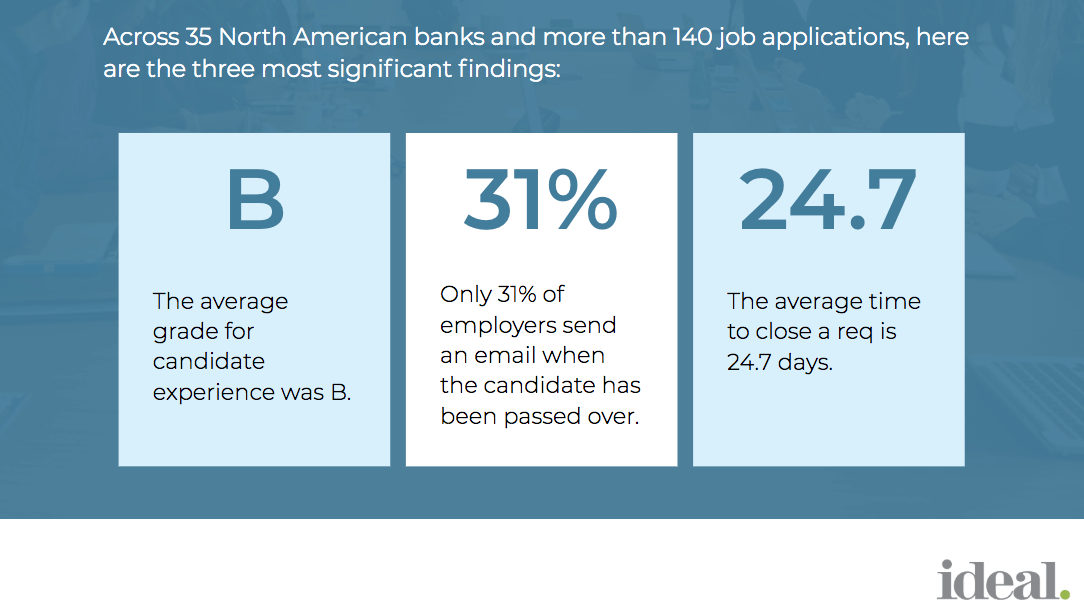

Across 35 North American banks and more than 140 job applications, here are the three most significant findings:

- The average grade for candidate experience was B

- Only 31% of employers send an email when the candidate has been passed over

- The average time to close a req is 24.7 days

The Good

Leading banks are sending an immediate reply and allowing candidates to check the status of their application on their own terms via an applicant portal.

Creating an applicant portal serves the candidate on multiple levels. A robust portal:

- Allows the candidate to save their application if they are unable to finish it in one sitting

- Confirms that the candidate’s application has been submitted

- Allows the candidate to check the status of their application 24/7

- Includes a chatbot component that candidates can interact with

- Stores the applicant’s basic info if they choose to apply to another role in the future

- Allows for the company to obtain the candidate’s consent to push out relevant job openings in the future

- Allows for the company to include pieces of recruitment marketing such as quotes from current employees

Applicant portals are also a huge timesaver for recruiters and hiring managers. By allowing candidates to check on their application at any time, recruiters no longer need to field candidate’s calls about the status of their application.

Candidate-first job portals also feature the added benefit of allowing the applicant to filter through other roles they may be strong candidates for, keeping them a part of their network for longer.

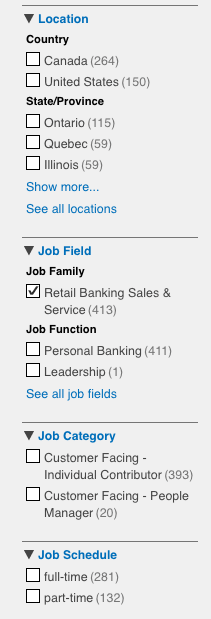

This is an example of a robust filtering function:

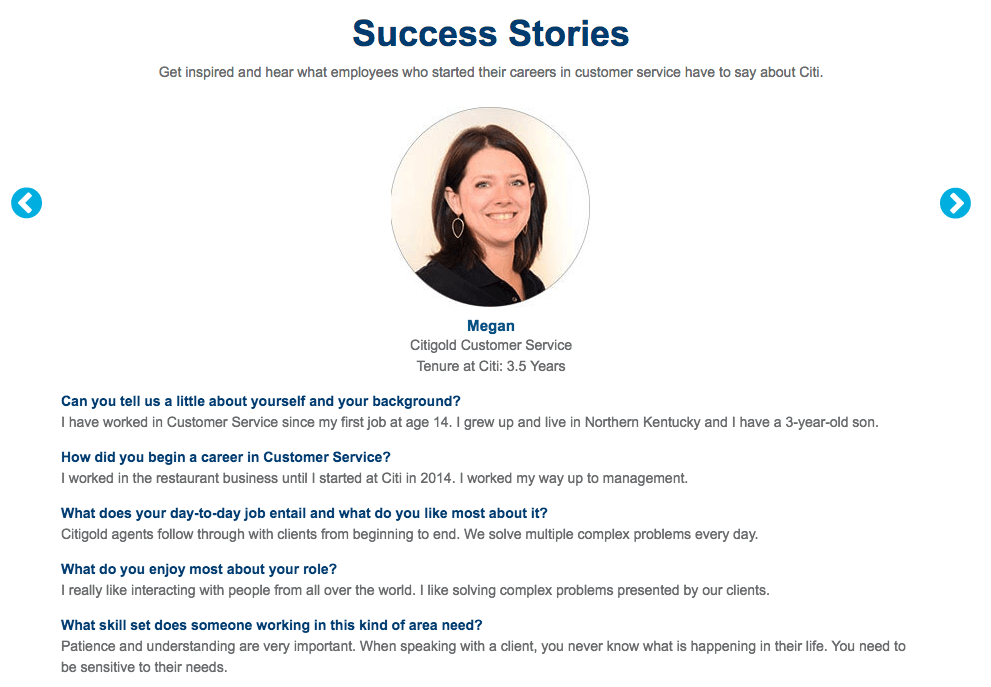

Finally, applicant portals allow the employer to showcase their employment branding. Strategic companies will add quotes and content from existing employees. This is an example of great recruitment marketing working its way into the applicant portal:

Recommendation:

- Offer an applicant portal for your candidates that they can access at any time

- The best portals keep user experience top of mind and are easy to navigate

- Consider adding a recruitment chatbot function to your outreach and qualifying questions (effortlessly take the place of a phone screen)

- Include sorting functionality within the portal such as Posting Date, Location, Job Field, Job Category, Job Schedule etc., this will help candidates find appropriate jobs faster and will also help decrease the number of unqualified candidates per req.

- Feature current employees as brand ambassadors throughout the portal answering FAQs and “Day In the Life” questions

The Bad

We found most banks are falling behind on “ease of application.” Ease of application, a qualitative factor, refers to the length of application, repetition and additional requirements. We divided this category into two smaller components, “Resume Upload” and “User Complexity.”

Resume Upload Feature

Interestingly, almost all banks were using some version of resume-parsing to, in theory, save time.

About half of the systems employed the use of parsing in this order: login > upload resume > the following page has auto-populated parts of the standardized application using the parsed data.

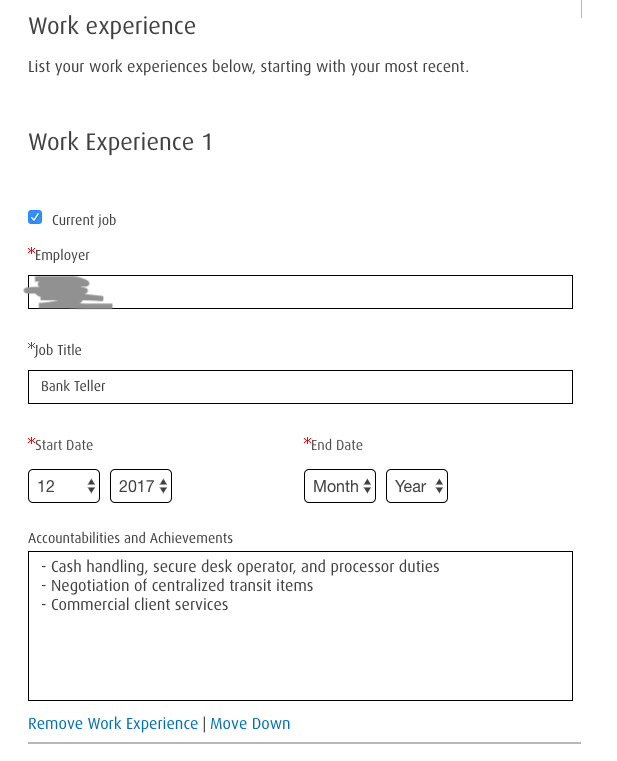

This is an example of helpful and time-saving resume parsing:

This technology is obviously not perfect but as far as convenience, this saves the candidate a lot of copy and pasting time.

Unfortunately, five of the banks had a resume parsing element – but asked for the resume upload after the rest of the application. So, after the candidate copied and pasted each line of their resume into the boxes, the system asked them to upload their entire resume. This is quite frustrating for the candidate and drastically extends the length of the application. Applications with this workflow experience a very high percentage of drop-offs.

Complexity of Online Application

Finally, we found some applications to be confusing, glitchy and they were sending “mixed signals,” forcing the candidate to decide between ease and a more robust application.

An example of “mixed signals” exists if the application says that the candidate does not require a cover letter but it still suggests that they can upload one. With this ambiguity the candidate may feel that a cover letter would still set them ahead of other candidates, even if the recruiter has no intention of reading them.

Recommendation:

- Offer resume-upload tool at the very beginning of the application that will fill in the blanks for the manual resume inputs

- Make sure the entire online process works on all browsers, is mobile-friendly and comprised of only a few separate pages

- Keep the initial application requirements light and follow-up with further qualifying questions via chatbot if necessary

- Avoid repeating identical questions (this happened more than you would think) or very similar questions back-to-back

- Choose to make a cover letter mandatory or do not accept cover letters at all

The Ugly

The two factors that hurt the candidate experience the most were the total absence of a rejection email and extremely delayed response times.

No Rejection Email

To our surprise, only 31% of employers sent a “rejection email” or an email showing that the candidate would not move forward in that role.

As a vendor in the HR tech space, this was a tough stat to uncover. Like one of our first customers once said, “Any good recruiter remembers what it’s like to be a candidate.” Saddled with more applicants and less resources, we can sympathize with well-meaning recruiters who don’t have a free minute in the day to follow up with candidates that have been passed over. However, this is a truly low-hanging fruit to address with technology. With the right vendor (Ideal), any role can be equipped with a chatbot or automated email service to follow up with candidates – avoiding what we affectionately call, “the candidate black hole.”

Time To Close Req

Research suggests that top candidates are off the market within ten days of applying to a role. Industry leading employers have used this data to create efficient, enjoyable candidate experiences. We applied for all roles within one week of each other and meticulously tracked if and when we heard back from the employer. This feature proved to be very polarizing. Top employers were closing open reqs within ten days. That is, if the first candidate applied on day one, the role was closed before day ten. This signals an efficient high-volume hiring process.

On the other hand – around 30% of applications sat open for over 100 days. After 100 days we concluded our research so we cannot say for sure if those requisitions ever closed.

One of the banks reached out to the candidate a full 93 days later. The implication here is a business struggling to engage with candidates in a timely manner, forcing them to spend a lot of time following up with candidates who are no longer on the market. The difference between 10 and 93 days can dramatically change the level of talent a company is able to attract.

Recommendation:

- Send a friendly, automated “rejection email” or chat message to every single candidate no matter what

- A robust chatbot could be programmed to suggest similar roles that the candidate may be a fit for

- Shortlist candidates within ten days of opening the role, this will ensure high candidate response rates and satisfaction

- Enlist resume screening software to make efficient high-volume hiring scalable

- Use AI-powered candidate screening to identify the top candidates based on millions of data points

What Banks Should Be Making Note Of

For Financial Institutions, much like retailers, your candidates are your customers. Poor candidate experience does not just exist online but also sticks with the candidate as a consumer and as we know, bad news travels fast.

A renewed focus on the candidate experience will immediately benefit job seekers, hiring managers and ultimately improve the company’s overall quality of hire. Top candidates ramp up faster, stay longer and perform better in their roles.

Summary of Candidate Experience Best Practices in 2019

Candidate experience is top of mind for CHRO’s around the globe. As the race for talent only continues to speed up, it will be critical to optimize your candidate experience in 2019. Here are our top recommendations:

- CareerBuilder found that in addition to an automated reply, 84% of candidates also expect a personal email response. Unfortunately, the volume of applicants makes this impossible. Many companies are solving this problem by employing chatbot technology that follows up with applicants with pre-qualifying questions and providing more information about the role.

- The second most requested feature from job seekers is “notification if passed over.” To avoid the dreaded “black hole”, consider adding an automated email informing candidates the role has been filled and encouraging them to apply to other roles at your organization.

- The lowest hanging fruit for improving your candidate experience is speeding up your recruiting process by automating time-consuming manual tasks. Recruitment automation software can help you speed up screening by using AI to learn the job requirements and then finding resumes of candidates who fit the qualifications.

- With the recent hiring discrimination lawsuits in the finance sector, banks should be investing in tools to help reduce or avoid unconscious bias during their recruiting process.

Want to learn more about our research and how we help major financial institutions improve their candidate experience? Let’s chat!